Property Tax In North Dakota . calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Compare your rate to the north dakota and u.s. The state board of equalization (sboe) meets the first thursday of the month. property taxes in north dakota are based on the value of the real estate being taxed. this page is intended to help you understand property taxes in general, and the often confusing mill in particular. in north dakota, a household with a median value of $280,600 would face an effective tax rate of 0.98% in property. taxation of rural electric cooperatives. Taxation of cooperative electrical generating plants. In fargo, the assessment department.

from www.templateroller.com

calculate how much you'll pay in property taxes on your home, given your location and assessed home value. taxation of rural electric cooperatives. property taxes in north dakota are based on the value of the real estate being taxed. this page is intended to help you understand property taxes in general, and the often confusing mill in particular. in north dakota, a household with a median value of $280,600 would face an effective tax rate of 0.98% in property. In fargo, the assessment department. Taxation of cooperative electrical generating plants. Compare your rate to the north dakota and u.s. The state board of equalization (sboe) meets the first thursday of the month.

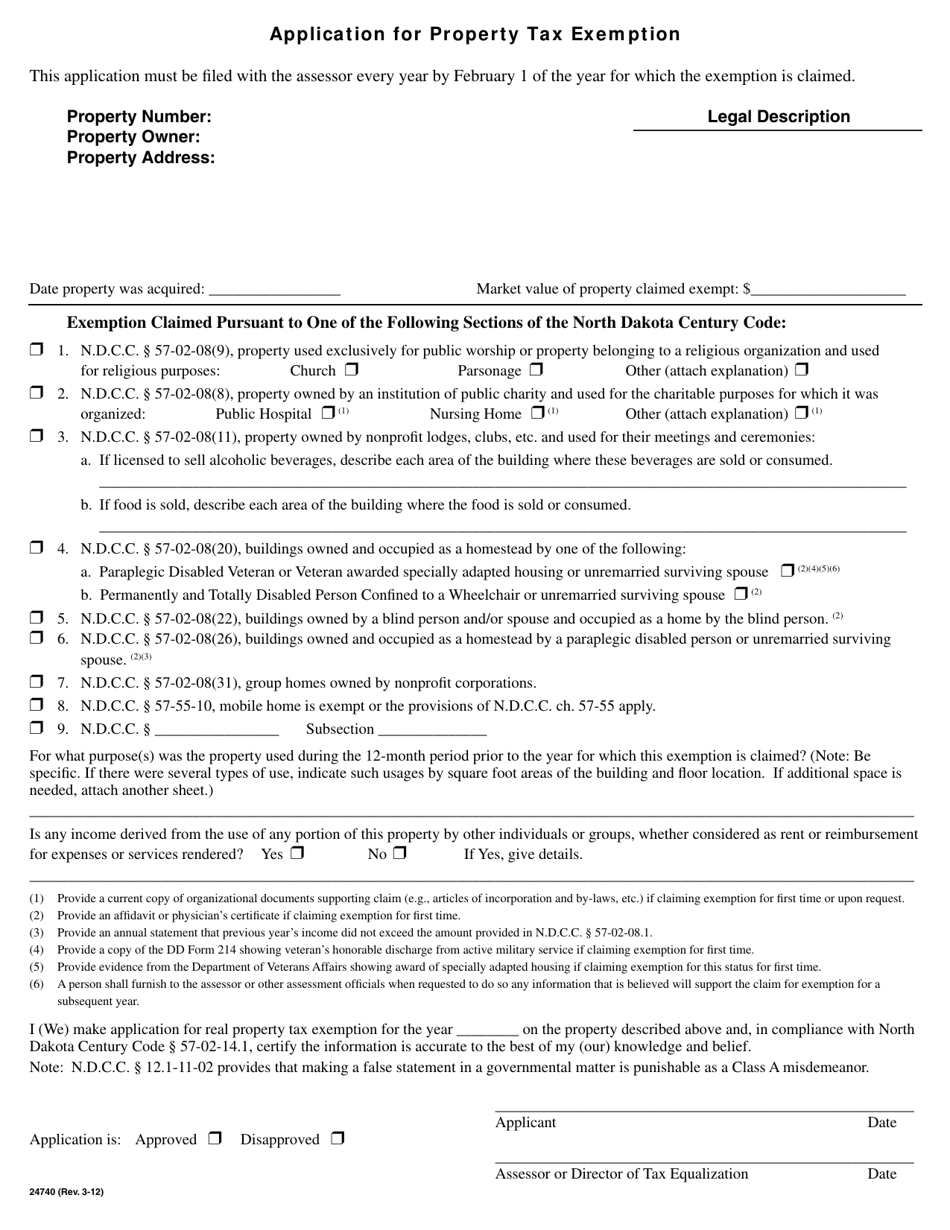

Form 24740 Fill Out, Sign Online and Download Fillable PDF, North

Property Tax In North Dakota The state board of equalization (sboe) meets the first thursday of the month. in north dakota, a household with a median value of $280,600 would face an effective tax rate of 0.98% in property. Taxation of cooperative electrical generating plants. this page is intended to help you understand property taxes in general, and the often confusing mill in particular. The state board of equalization (sboe) meets the first thursday of the month. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. In fargo, the assessment department. Compare your rate to the north dakota and u.s. property taxes in north dakota are based on the value of the real estate being taxed. taxation of rural electric cooperatives.

From www.msn.com

Will North Dakota Property Tax Be Eliminated? Property Tax In North Dakota Taxation of cooperative electrical generating plants. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. The state board of equalization (sboe) meets the first thursday of the month. Compare your rate to the north dakota and u.s. property taxes in north dakota are based on the value of the. Property Tax In North Dakota.

From www.templateroller.com

Form SFN24770 Download Fillable PDF or Fill Online Application for Property Tax In North Dakota In fargo, the assessment department. this page is intended to help you understand property taxes in general, and the often confusing mill in particular. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Compare your rate to the north dakota and u.s. taxation of rural electric cooperatives. . Property Tax In North Dakota.

From dailysignal.com

How High Are Property Taxes in Your State? Property Tax In North Dakota property taxes in north dakota are based on the value of the real estate being taxed. in north dakota, a household with a median value of $280,600 would face an effective tax rate of 0.98% in property. this page is intended to help you understand property taxes in general, and the often confusing mill in particular. In. Property Tax In North Dakota.

From www.foxnews.com

Will North Dakota Decide to Eliminate Property Taxes? Fox News Video Property Tax In North Dakota in north dakota, a household with a median value of $280,600 would face an effective tax rate of 0.98% in property. this page is intended to help you understand property taxes in general, and the often confusing mill in particular. The state board of equalization (sboe) meets the first thursday of the month. Taxation of cooperative electrical generating. Property Tax In North Dakota.

From exoaovhef.blob.core.windows.net

North Dakota Vehicle Property Tax at Anthony Ramirez blog Property Tax In North Dakota this page is intended to help you understand property taxes in general, and the often confusing mill in particular. In fargo, the assessment department. Compare your rate to the north dakota and u.s. taxation of rural electric cooperatives. property taxes in north dakota are based on the value of the real estate being taxed. Taxation of cooperative. Property Tax In North Dakota.

From infotracer.com

North Dakota Property Records Search Owners, Title, Tax and Deeds Property Tax In North Dakota In fargo, the assessment department. this page is intended to help you understand property taxes in general, and the often confusing mill in particular. Compare your rate to the north dakota and u.s. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. The state board of equalization (sboe) meets. Property Tax In North Dakota.

From www.templateroller.com

Form 24840 Download Fillable PDF or Fill Online Application for Property Tax In North Dakota in north dakota, a household with a median value of $280,600 would face an effective tax rate of 0.98% in property. this page is intended to help you understand property taxes in general, and the often confusing mill in particular. calculate how much you'll pay in property taxes on your home, given your location and assessed home. Property Tax In North Dakota.

From www.grandforksherald.com

North Dakota homeowners have 1 more week to apply for property tax Property Tax In North Dakota taxation of rural electric cooperatives. Taxation of cooperative electrical generating plants. property taxes in north dakota are based on the value of the real estate being taxed. In fargo, the assessment department. this page is intended to help you understand property taxes in general, and the often confusing mill in particular. calculate how much you'll pay. Property Tax In North Dakota.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Property Tax In North Dakota property taxes in north dakota are based on the value of the real estate being taxed. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. The state board of equalization (sboe) meets the first thursday of the month. taxation of rural electric cooperatives. this page is intended. Property Tax In North Dakota.

From www.nj.com

North Dakota's nopropertytax dream is infectious Property Tax In North Dakota property taxes in north dakota are based on the value of the real estate being taxed. Taxation of cooperative electrical generating plants. in north dakota, a household with a median value of $280,600 would face an effective tax rate of 0.98% in property. calculate how much you'll pay in property taxes on your home, given your location. Property Tax In North Dakota.

From www.templateroller.com

Form SFN28742 Schedule ND1TC Download Fillable PDF or Fill Online Tax Property Tax In North Dakota Taxation of cooperative electrical generating plants. Compare your rate to the north dakota and u.s. The state board of equalization (sboe) meets the first thursday of the month. property taxes in north dakota are based on the value of the real estate being taxed. In fargo, the assessment department. in north dakota, a household with a median value. Property Tax In North Dakota.

From www.armstrongeconomics.com

US Property Tax Comparison by State Armstrong Economics Property Tax In North Dakota in north dakota, a household with a median value of $280,600 would face an effective tax rate of 0.98% in property. Compare your rate to the north dakota and u.s. Taxation of cooperative electrical generating plants. In fargo, the assessment department. taxation of rural electric cooperatives. property taxes in north dakota are based on the value of. Property Tax In North Dakota.

From www.dochub.com

Nd sales tax form Fill out & sign online DocHub Property Tax In North Dakota Taxation of cooperative electrical generating plants. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. taxation of rural electric cooperatives. Compare your rate to the north dakota and u.s. in north dakota, a household with a median value of $280,600 would face an effective tax rate of 0.98%. Property Tax In North Dakota.

From taxfoundation.org

How Does Your State Rank on Property Taxes? 2019 State Rankings Property Tax In North Dakota Compare your rate to the north dakota and u.s. property taxes in north dakota are based on the value of the real estate being taxed. The state board of equalization (sboe) meets the first thursday of the month. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. taxation. Property Tax In North Dakota.

From www.templateroller.com

Form 24740 Fill Out, Sign Online and Download Fillable PDF, North Property Tax In North Dakota In fargo, the assessment department. The state board of equalization (sboe) meets the first thursday of the month. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Compare your rate to the north dakota and u.s. Taxation of cooperative electrical generating plants. in north dakota, a household with a. Property Tax In North Dakota.

From listwithclever.com

The Ultimate Guide to North Dakota Real Estate Taxes Property Tax In North Dakota in north dakota, a household with a median value of $280,600 would face an effective tax rate of 0.98% in property. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. property taxes in north dakota are based on the value of the real estate being taxed. Taxation of. Property Tax In North Dakota.

From www.pinterest.com

NorthDakota state and local taxburden has grown 58 between FY 1950 Property Tax In North Dakota calculate how much you'll pay in property taxes on your home, given your location and assessed home value. The state board of equalization (sboe) meets the first thursday of the month. property taxes in north dakota are based on the value of the real estate being taxed. In fargo, the assessment department. this page is intended to. Property Tax In North Dakota.

From www.templateroller.com

Form SFN28724 Schedule ND1NR Download Fillable PDF or Fill Online Tax Property Tax In North Dakota calculate how much you'll pay in property taxes on your home, given your location and assessed home value. taxation of rural electric cooperatives. in north dakota, a household with a median value of $280,600 would face an effective tax rate of 0.98% in property. this page is intended to help you understand property taxes in general,. Property Tax In North Dakota.